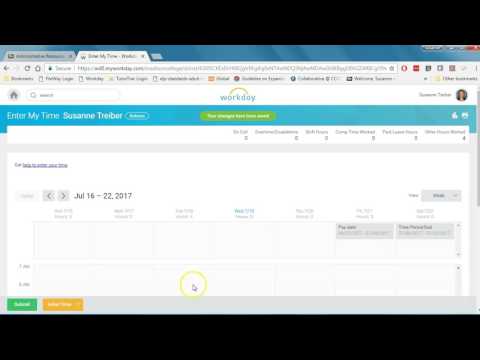

A time card allows you to have in order all the days and hours you have worked during a period of time. It essentially contains all the times when you started, paused, or stopped working. An online time card makes it easy for you to know how many hours you have worked in total and how much you should get paid based on the hourly rate you provide, if you choose to do so.

It gives you the possibility to include overtime, breaks, to work with different time periods. With its simple and clean design the payroll hours calculator above makes it quick & easy to get the job done properly. If the employee in this example was paid a monthly salary, instead of semi-monthly, overtime pay would be calculated in the same way. First, the workweek must be determined and hours worked totaled for each workweek.

Overtime pay is then calculated based on the total number of hours worked in each workweek, even when those workweeks cut across pay periods. Workweeks 1 and 5 would have hours worked, including overtime hours, which cut across pay periods. Non-exempt employees are employees that are entitled to minimum wage as well as overtime pay under the FLSA. Employers are also required to pay these workers an overtime rate of 1.5 times their standard rate when they work more than 40 hours per workweek. A non-exempt employee that is not paid overtime wages can file an FLSA overtime claim through the U.S.

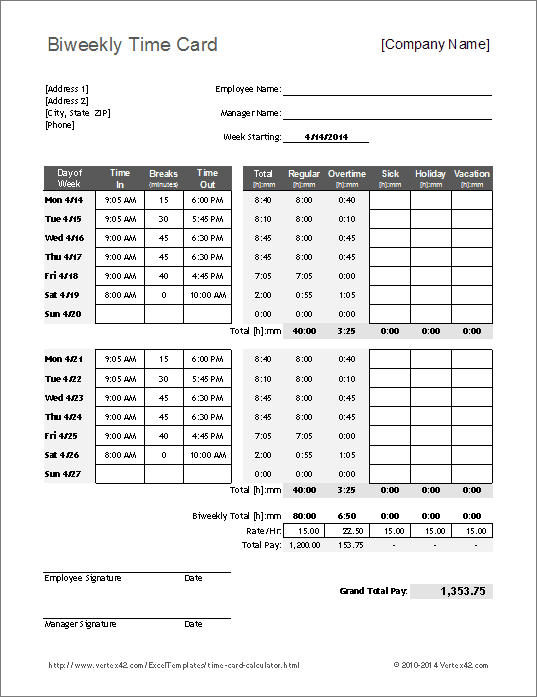

Most workers that are paid an hourly wage fall under this category. OT Overtime The Time Card summary shows regular work hours and overtime hours. If you are paid on an hourly or daily basis, the annual salary calculation does not apply to you. Your bi-weekly pay is calculated by multiplying your daily or hourly rate times the number of days or hours you are paid. Then just use the rows of fields to enter the start and end times and the total amount of breaks .

If you get paid extra for overtime, select the corresponding overtime scheme and enter the pay rate ratio in the time sheet calculator. 1.5 overtime pay means that you get 50% higher hourly rate for overtime hours, compared to regular hours. Employees are providing an average of two months of work to employersfor free every year.

Any employee who works in excess of 38 hours per week or 7.6 hours in a day must be paid overtime. Managers can discipline employees for not following company overtime policies – but business owners can't deny employees overtime pay. • Input your hourly wage, normal hours per week, overtime hours, and no. of weeks worked in a year to determine weekly and annual salary. Employees who worked less than 40 hours per week on average during a specific calculation period will have their average hours worked on a weekly basis added together. Divide this total number with 40, and then round the total to the nearest tenth to get the total FTE. This is usually 40 hours per week if you are a full-time employee.

Workweek 5 also includes hours worked outside the pay period, minus 8 hours worked on April 1. Since the total hours worked for this workweek is 44, overtime pay is due for 4 hours. However, because the time cuts across two pay periods, the additional pay for overtime hours worked will be due with the employee's regular earnings for the following pay period.

In Workweek 3 the employee worked a total of 43 hours, including 3 overtime hours. Hours worked on March 13, 14, and 15 in Workweek 3 were paid at a straight-time rate in Pay Period One. This is your annual salary based on your hourly wage and the number of hours you are paid for each week (weekly pay times 52.14 weeks per year).

This form is for calculating your annual, monthly, weekly, daily and hourly rates of pay. Please only enter the values for the time you are supposed to work. See our Overtime Calculator to calculate the value of extra unpaid hours you put in. In Texas, the Fair Labor Standards Act sets out the rules regarding overtime pay for employees.

This federal law requires employers to compensate employees at a rate of one and half times their regular rate for hours worked over 40 during a workweek. After determining the number of allowable hours per week, a work schedule can be established between the supervisor and the student. The department and the student share the responsibility in monitoring the earnings. The SEO will notify employers when the student is within $500.00 of the award limit.

To monitor the student's allocation from pay period to pay period, deduct the gross amount paid from the total allocation awarded. Generally, the exemptions discussed above only apply to "white collar" employees. No matter how highly paid non-management employees in production, maintenance, or construction are, they are entitled to a minimum wage and overtime pay. This includes professions such as carpenters, electricians, mechanics, plumbers, ironworkers, craftsmen, and construction workers. Our employee time clock calculator automatically does time clock conversion from hours and minutes to decimal time.

It can also calculate military time for payroll with the 24 hour military time clock setting. You can specify how you want to round decimal hours in the calculator settings. From the people at Calculator Soup, this free time card calculator keeps track of work hours, breaks and pay on a daily, weekly or monthly basis. It allows multiple breaks per day and can auto-deduct breaks from your total hours worked.

Our time card calculator automatically tabulates all work hours and converts them to dollars and cents. The calculator is totally electronic, ridding your business of those cumbersome and error-prone paper time card weekly and monthly reports that get bent, torn, or lost. • Calculate annual salary, monthly salary, and weekly salary from an hourly wage with this hourly wage calculator. A new feature of this Timecard Calculator is that if you enter someone's hourly rate, it will calculate their gross pay.

If you don't want to use this feature, just leave those boxes alone and this will still calculate an employee's total hours. Each employee who worked 40 or more hours per week on average, during a specific calculation period counts as 1.0 FTE. No employee can be greater than 1.0 FTE, as overtime is not counted for this calculation.

After filling in any start or stop times for your employees enter in any lunch or break deductions. The free time card calculator will create a time sheet report with totals for your daily and weekly work hours. In leap years, the calculation of your bi-weekly gross is based on 366 days instead of regular 365 days.

Your annual salary remains the same whether it is a leap year or not. Your bi-weekly gross changes slightly in the first pay period of a leap year and in the first pay period after the end of a leap year, due to the one day difference. This overtime calculator is a tool that finds out how much you will earn if you have to stay longer at work. All you have to do is provide some information about your hourly wages, and it will calculate the total pay you will receive this month. Finally, enter your base hourly rate in the timesheet calculator, if you want your time card to contain not just work hours data, but also payment due. Assuming you work 40 hours every week, however clock out for a half an hour lunch a day, this means you only receive a commission for 37.5 hours in line with the time you work in the week.

Multiply the quantity of hours you figure per week via your hourly wage. Assuming you earn $25 an hour and work 37.5 hours consistently within the week, your annual salary is $25 × 37.5 × 52, or $48,750. For Workweek 1 the employee worked 20 hours (worked February 26-28) in the preceding pay period. The employee worked a total of 44 hours for the workweek so overtime pay is due for the 4 hours worked in excess of 40. When you're done, click on the "Calculate!" button, and the table on the right will display the information you requested from the tax calculator.

You'll be able to see the gross salary, taxable amount, tax, national insurance and student loan repayments on annual, monthly, weekly and daily bases. However, the first step is the same for all salaried employees一determine the regular rate. To do this, take the employee's weekly salary and divide it by the number of hours the salary is meant to compensate. For example, an employee who earns $400 for a 40-hour workweek has a regular rate of $10/hour ($400/40 hours). Nonexempt employees, most of which are hourly workers, are those entitled to both minimum wage and overtime pay of at least 1.5x their standard wage.

Rather than manually calculating employee hours and pay for payroll, this simple timesheet calculator will automatically calculate total hours and gross pay for you. Besides performing payroll processing, they may take custody of your payroll cash. Look no further – our timecard calculator helps you determine your gross pay. Once you've got the gross pay, the next step is finding a good payroll company to calculate your taxes and deductions.

Payroll administrators can calculate employee time card hours and minutes worked per week or pay period. Here are the steps to calculate annual income based on an hourly wage, using a $17 hourly wage, working 8 hours per day, 5 days a week, every week, as an example. Calculate annual salary from hourly wage and the monthly, bi-weekly, weekly, and daily equivalents. According to the Fair Labor Standards Act, employers are required to pay time and a half wages (regular rate x 1.5) for all hours worked beyond 40 hours per week. Overtime is the hours an employee works that exceed full time.

According to the Fair Labor Standards Act , the pay rate for overtime is 1.5 times the regular hourly rate. According to the FLSA rules, nights, weekends, or holidays do not require to be paid as overtime (unless the worker would cross the regular hours' threshold). Many employers state additions to regular wages for hours done on evenings, weekends, or holidays on their own. If you are working out the new salary by number of hours worked, enter the pro-rata number of weekly hours into the "Pro-rata weekly hours" box.

If you want to see a percentage of your current salary, enter that percentage into the "% of full-time salary" box. This calculator will help you to quickly convert a wage stated in one periodic term (hourly, weekly, etc.) into its equivalent stated in all other common periodic terms. The Annual Salary Calculator will translate your hourly pay into its yearly, monthly, biweekly, weekly and daily equivalents, including any weekly time-and-a-half overtime wages. Just to be clear on what wage is in comparison to salary, wage is a compensation based on the number of hours worked and multiplied by the rate of pay per hour. A salary is a an agreed amount of annual pay for completing tasks rather than working hours. This pay is usually paid out weekly, monthly, or bi-weekly.

Companies are not required to pay overtime for salaried employees, and part-time hourly employees need to exceed 40 hours per week to earn overtime pay. Employees can record their work time with clock software on computers or mobile devices. They log in to a website or application, then just click a button to clock in and out.

Some software can be location-enabled to ensure employees clock in and out while at work. The software automatically calculates hours worked per pay period. Uncertified sick leave or unpaid leave is not allowed for calculating holidays due to an employee. It is necessary for the user to input the amount of day's uncertified sick leave or unpaid leave included in the weeks paid per file. This will reduce the weeks worked for calculating the holidays due to the employee. To enter sick or unpaid leave days simply click on the blue box, enter the date, amount of days and comment and click on update.

The payroll software sets the working week at 5 days per week and 7.5 hours per day. The working week should be amended where necessary for each employee as it will directly effect calculation of holiday entitlements. Each employee who worked less than 40 hours per week on average during a specific calculation period counts as 0.5 FTE and is viewed as a part-time employee. Each employee who worked more than 40 hours per week on average during a specific calculation period counts as 1.0 FTE and is viewed as a full-time employee. Clockify lets you track your cost rates per employee and then compare and contrast them with employee billable hourly rates. They also use it to calculate labor costs for the expected project workload and subsequently define the amount of funds needed to carry out the project to its end.

Enter the number of hours, and the rate at which you will get paid. For example, for 5 hours a month at time and a half, enter 5 @ 1.5. There are two options in case you have two different overtime rates. To keep the calculations simple, overtime rates are based on a normal week of 37.5 hours.

The FLSA requires employers to pay salaried employees overtime as well. Calculating overtime for employees who receive a salary takes a bit more work because the calculations differ based on the employee's fixed workweek. First, you'll need to input your hours for the week into the time card calculator. You'll notice that every day of the week gets its own row.

Add the time you clocked in and out for each day worked, as well as the start and end times of your break. You then do overtime of eight hours a week for the first 12 weeks of your 17-week reference period. You also take four days annual leave and work one normal day that week.

When you return to work, you only do your normal hours with no overtime for one week. As you fill in the clock in and clock out times, the calculator determines the employee's total hours and total gross pay. The first clock card time recording machine, the Rochester Time Recorder, was invented by Daniel M. Cooper in 1894. This clock was able to print accurate clock-in and clock-out times on individual clock cards that employees would carry and insert into the clock whenever they started or ended their shift. Upon insertion, the time recorder would print the exact time on the card, allowing the company timekeeper to then calculate how many hours each employee worked at the end of each week. Use this calculator to add up your work week time sheet and calculate work hours for payroll.

This online time clock uses a standard 12-hour work clock with am and pm or a 24-hour clock for military time. Some employers who have mid-level management on salary often view getting management to work a bit longer as free labor. This is your monthly salary based on your hourly wage and the number of hours you are paid for each week. Overtime pay (sometimes referred to as "OT") is typically the wages paid in excess of regular hours worked beyond 40 hours per week. Employers can set different amounts for full time as long as it doesn't exceed 40 hours per week. For example, a company could consider 32 hours per week full time for its employees.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.